Branded Residences: a success story and a new real estate asset class for the French Market

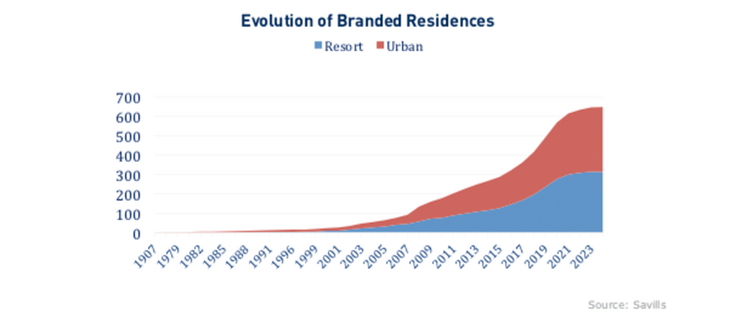

Branded Residences first appeared in New York in the 1920s, when the Sherry-Netherland Hotel opened its doors in Manhattan. For most of the 20th century, branded residences were a niche segment of the luxury real estate market and targeted at privileged HNWI audiences.

In its simplest terms, branded residences are luxury residential properties associated with a brand. Historically the domain of exclusive hoteliers, branded residences provide would-be buyers the opportunity to purchase their own exquisitely designed permanent quarters.

They come with a brand name that buyers trust, prime location, first-class facilities, and crucially, they can be a good investment. Owners have access to the same luxury services and facilities as the hotel guests, delivering a luxurious, unique and convenient lifestyle that is very suitable and appealing to executives and high net worth individuals.

As per Savills, the average global premium for branded residences, over a comparable non-branded product, stands at 30% on an unweighted basis. It should be noted that these premiums do vary significantly by location, brand, and type of scheme.

Resort locations tend to have more varied price premiums which are highly dependent on local market composition, across the resort markets studied, premiums stand at 32% when compared to equivalent non-branded properties. These markets, as the classification suggests, are popular with second home buyers looking for a peaceful and relaxing escape .

Branded Residences offer higher yields and sales premium, lower operating costs, hassle-free management and a quicker sale than regular properties.

As per Savills, the average global premium for branded residences, over a comparable non-branded product, stands at 30% on an unweighted basis. It should be noted that these premiums do vary significantly by location, brand, and type of scheme.

Resort locations tend to have more varied price premiums which are highly dependent on local market composition, across the resort markets studied, premiums stand at 32% when compared to equivalent non-branded properties. These markets, as the classification suggests, are popular with second home buyers looking for a peaceful and relaxing escape.

Global cities have the lowest premium for the location classifications at 24%. The limited supply of branded residences also serves to protect prices, add to that continued investment from the brand into the scheme and there is a long-lasting appeal for buyers.

There is a possibility for owners to rent out their apartments in hotel-branded residences given the brand recognition and the fact that many of them will have their own rental pools or programs already set up along with an existing pool of potential clients with an affinity for the brand.

Indeed, many schemes offer in-built and guaranteed rental yields depending on various factors, including when the property was purchased and how much it is used per year. Potential returns range from 3 to 5% net yield.

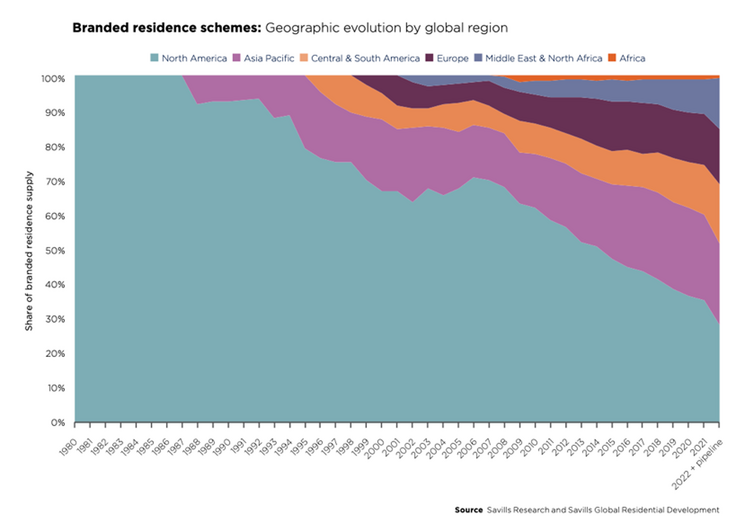

The market of Branded Residences is growing fast and worldwide, both in urban and resort prime locations.

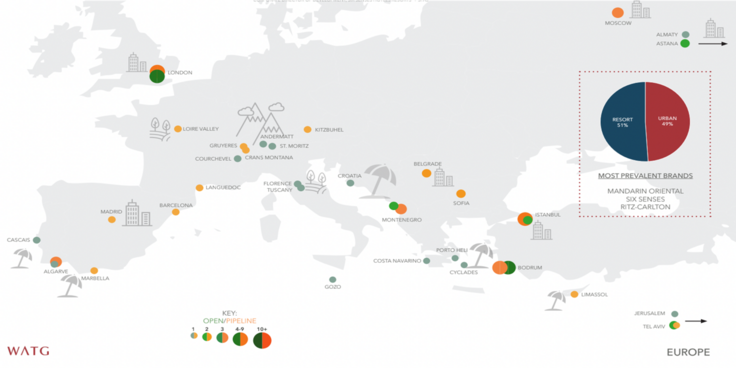

European countries represent today around 10% of the market of Branded Residences worldwide. This asset class is growing fast in Europe.

At Proprietes & Co., we mix the luxurious to the beneficial, within our first and only branded residences project on the whole French Southern coast, located on a one of a kind 60,000 Sqm prime waterfront land overlooking the Mediterranean, offering from apartments to breathtaking waterfront villas that matches all tastes & budgets.

More info : www.port-marseillan.com